Oakland set to declare “extreme fiscal necessity” again, coordinate with unions to increase property taxes

City council finance committee to review the FY 2024-25 revenue and expenditure report, annual consolidated financial report, and a proposed parcel tax increase — Oakland Agenda Watch

Oakland Agenda Watch provides short summaries of key items on upcoming public meeting agendas that catch our attention. Today we take a look at the city council finance and management committee agenda for February 10, 2026

Buy now, pay later

There are over 100 “payday loan” locations in Oakland and the immediate area.1 A payday loan is a short-term, high-interest, unsecured cash loan, designed to be paid by the borrower’s next paycheck. These loans are characterized by high fees (often with triple-digit Annual Percentage Rates), minimal creditworthiness requirements, and repayment usually due within two to four weeks. The loan comes due quickly, with steep interest, whether the borrower keeps their job or not.

The City of Oakland’s financial state is not unlike that of a typical payday loan borrower. Desperate to cover expenses and short of cash, yet unable or unwilling to make structural changes to an unsustainable financial condition, they consistently turn to desperate measures such as using one-time income (selling assets), borrowing against the future (spending income they don’t have yet), and asking their family, friends and neighbors (i.e. taxpayers) for yet more financial help.

Help us reach our goal of 10,000 subscribers

City’s year-end financial reports show reliance on one-time money to cover ongoing expenses — again

Finance and management committee, Feb. 10, 2026, agenda items #4 and #5

The finance and management committee will review the overdue City of Oakland Fiscal Year (FY) 2024-25 Fourth Quarter Revenue and Expenditure Report, which comes more than seven months after the fiscal year ended on June 30, 2025.2 Also up for review is the Annual Consolidated Financial Report for FY 2024-25.3

Both reports highlight a budget surplus for the year. But the details paint a different picture.

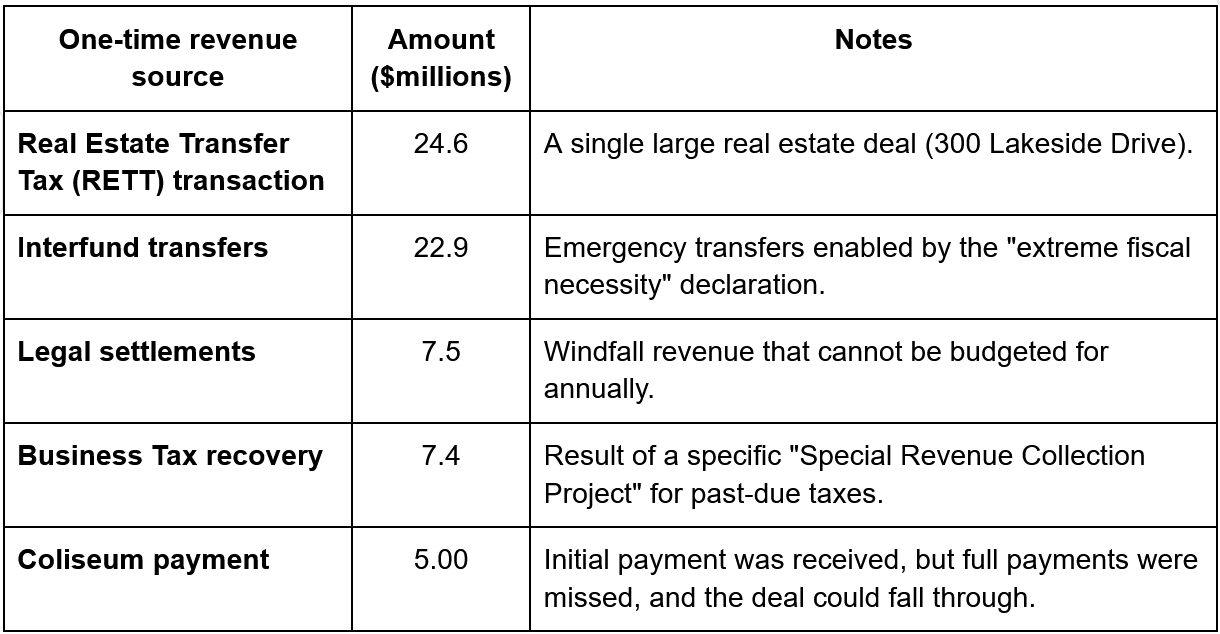

According to the reports, the city’s General Purpose Fund (GPF) shows a year-end operating surplus of $73.6 million in FY 2024-25. However, this seemingly positive news was not driven by structural stability or recurring revenue growth. Rather, the surplus was manufactured through over $67 million in one-time revenues, including emergency interfund transfers, one-time tax income from a single large real estate transaction (the iconic 300 Lakeside Drive office tower Kaiser Permanente sold to Pacific Gas & Electric for $908 million last year), and aggressive, temporary austerity measures including a citywide hiring freeze.

See this related article:

The financial reports’ details show that beneath the headline surplus lies a precarious financial position: after accounting for carry-forward appropriations and encumbrances, the actual available year-end fund balance is a modest $16.9 million — which is primarily a surplus on paper that was only made possible by accounting transfers, one-time revenues, and significant and unsustainable one-time expenditure reductions.

One-time belt-tightening helped, but structural deficit remains unaddressed

Back in September, deputy city administrator Monica Davis reported to the finance and management committee that the prior fiscal year (July 1, 2024 to June 30, 2025) potentially ended with a General Purpose Fund (GPF) deficit of $55 million.4 The exact extent of the potential deficit was not known because the city had not released its fourth-quarter financial report yet.

To avert this dire outlook, the city had implemented aggressive austerity measures, including:

Hiring freeze & vacancy management: A citywide freeze on non-sworn positions and “aggressive vacancy controls.”

Spending moratoriums: Departments were instructed to curtail discretionary spending, delay contracts, and pause professional training requests.

Cost deferrals: Savings were realized through the deferral of some costs into the current fiscal year 2025-26. City staff explicitly warned that these savings were temporary and will re-emerge as future obligations.

Public safety reductions: $30 million in one-time public safety reduction measures, though these do not represent ongoing structural savings.

Thus, the savings were achieved largely through temporary delays in spending, rather than structural reductions. The deferral of costs into FY 2025-26 creates immediate pressure on the current and next budget cycle.

Put another way, while the austerity measures were effective at reducing cash outflows in the short term, they created a “bow wave” of deferred costs and liabilities that are likely to negatively impact the city’s finances for months and potentially years into the future.5

Fast-forward to the February 10 financial reports, and now finance director Bradley Johnson is presenting a $73.6 million surplus (only $16.9 million of which is realistically available).

This seems like good news, but city staff emphasizes that the city council still needs to extend its declaration of “extreme fiscal necessity” — which has been in effect nearly two years — in order to avoid losing voter-approved tax revenue due to failing to uphold voter-mandated minimum public safety staffing levels.6

According to the February 10 reports, public safety departments continue to significantly overspend due to high use of overtime — which is, in turn, driven by chronic staffing shortfalls and inability to recruit and retain personnel. Service levels continue to erode due to persistently high vacancy rates, currently at 13% across the city organization.

One-time revenues: a manufactured surplus

The reported FY 2024-25 surplus was heavily subsidized by over $67 million in non-recurring (one-time) revenues. These revenues will not exist in FY 2025-26, creating a fiscal cliff if baseline spending is not adjusted.

City is coordinating with public employee unions to increase property-based taxes

Finance and management committee, Feb. 10, 2026, agenda item #5

A significant component of the city’s budget-balancing strategy involves a hoped-for $40 million in annual revenue from a new tax increase on Oakland properties planned for the June 2026 ballot.

The city council is already spending the money. The city council has included the revenue in its FY 2025-26 operating budget, even though the new tax has not been put on the ballot for a vote yet.

As Oakland Report reported last week, the city’s public employee unions now are funding paid signature-gatherers to collect signatures to put a new parcel tax on the June 2026 ballot. Their proposed new tax would raise up to $40 million — the exact amount the city council budgeted.7

See this related article:

Service Employees International Union (SEIU) Local 1021 appears to be leading the campaign committee, “Oaklanders For A Safe, Clean & Healthy City, Sponsored By Labor Organizations,” to put the tax increase on the 2026 ballot. SEIU has already contributed $200,000 to the campaign.

The campaign committee’s donors also include the International Association of Fire Fighters (IAFF) Local 55 which contributed $150,000, and the International Federation of Professional and Technical Engineers (IFPTE) Local 21 which contributed $50,500. PG&E contributed $50,000.8

Notably, with a “citizen-sponsored” ballot initiative such as the one the public unions are leading — even a parcel tax — the threshold for voter approval is a simple majority (50% plus 1). If the new tax was placed on the ballot by the city council, the approval threshold would be much higher at two-thirds (66.67%).

The city’s “roadmap to fiscal health” runs through Oaklanders’ pocketbooks

Finance and management committee, Feb. 10, 2026, agenda item #6

The finance and management committee will review the city administrator’s “Oakland Roadmap to Fiscal Health,” which outlines a five-year strategy to achieve compliance with staffing requirements set by previous voter-approved tax measures, and to resolve the city’s persistent structural deficit, which is currently projected at $115 million to $135 million annually through 2030.9

As the “roadmap” states, the most urgent risk is the city’s ongoing failure to comply with Measure NN, which mandates 700 sworn police officers by July 1, 2026. With current funding for only 678 officers and recruitment deemed “not feasible” to close the gap, the city risks the automatic suspension of the Measure NN parcel tax revenue unless the current “extreme fiscal necessity” declaration is extended.

According to the report, in order to navigate this crisis the city must pursue another tax increase to collect another $40 million annually from Oaklanders.

The city administrator’s report summarizes the city’s approach and is worth quoting at length here because it speaks for itself:

“Administration recently presented an informational report outlining possible revenue options to generate an additional $40 million in ongoing revenues to maintain operations and support key systems such as 911 dispatch, IT infrastructure, and public safety.

While that analysis addresses the broader fiscal deficit, it highlights the same structural issues existing in this context of the City’s revenue base not able to sustain existing services, much less fund all MOEs [maintenance of effort] and MOUs [memoranda of understanding with public employee unions]. The supplemental report provided additional detail on how those tools could be structured, their revenue potential, and associated legal or administrative considerations.

The revenue options identified in the earlier $40 million analysis remain applicable for consideration in this context. Those same strategies could be considered to generate the additional revenue needed.

Staff is happy to conduct additional research on potential revenue options that Council may wish to explore and refine further as this process continues.”

— Oakland city administrator Jestin D. Johnson10

Based on the evidence in this and other city documents, it is clear that the city council is aware of and has committed to placing a tax increase on the 2026 ballot to “generate an additional $40 million in ongoing revenues to maintain operations and support key systems such as 911 dispatch, IT infrastructure, and public safety.”

This is the exact same criteria the public employee unions are now proposing in the parcel tax measure for which they are currently gathering signatures.

By all appearances, the city council and the public employee unions are coordinating in plain sight to increase taxes on Oaklanders by shifting the planned ballot measure from a city council-sponsored measure that requires a two-thirds vote to pass, to a “citizen-sponsored” initiative that only requires a simple majority.

See this related article:

Oakland Report is by no means comprehensive in our coverage of public meetings in Oakland. The scope and frequency of public meetings are far more than we can presently cover.

You can see the full February 10 finance and management committee agenda and meeting materials on the city’s meeting calendar.

DONATE TO SUPPORT OUR WORK

We are a 501(c)(3) charitable nonprofit based in beautiful Oakland, California. Our mission is to make truth more accessible to all Oakland residents through investigative reporting and evidence-based analysis of local issues.

Thank you.

Yelp.com. “Payday loan locations in Oakland, California.” Accessed Feb. 10, 2026. https://www.yelp.com/search?find_desc=Check+Cashing%2FPay-day+Loans&find_loc=Oakland%2C+CA

City of Oakland. “Receive An Informational Report On Fiscal Year (FY) 2024-25 Fourth Quarter (Q4) Audited Results For The General Purpose Fund (GPF, 1010), And Select Funds.” Finance and management committee meeting, Feb. 10, 2026, agenda item #3. https://oakland.legistar.com/LegislationDetail.aspx?ID=7801622&GUID=C51C149A-AA8D-41C8-8AFE-53CFFE5031DF&Options=&Search=

City of Oakland. “Receive The Annual Comprehensive Financial Report (ACFR) And The Auditor’s Required Communication To City Council (Management Letter) For The Year Ended June 30, 2025.” Finance and management committee meeting, Feb. 10, 2026, agenda item #4. https://oakland.legistar.com/LegislationDetail.aspx?ID=7801578&GUID=4EC97BF2-6575-4692-8C61-06802D8EEAB8&Options=&Search=

City of Oakland. “Options To Raise Additional Ongoing $40 Million In General Purpose Fund Revenues From: Office Of The City Administrator Recommendation: Receive An Informational Report With A List Of Options To Raise An Additional Ongoing $40 Million In General Purpose Fund Revenues Via An Ordinance To Adopt Or Increase A Tax Effective July 1, 2026, To Provide Ongoing Resources For Public Safety Services And To Maintain Key Equipment, IT Systems, And 911 Investments.” Finance and management committee meeting, Oct. 28, 2025, agenda item #3. https://oakland.legistar.com/LegislationDetail.aspx?ID=7682816&GUID=99E7DA17-0010-4166-956C-916DD82AF7CC&Options=ID%7CText%7C&Search=List+of+Options

A “bow wave” in the financial sense refers to a significant accumulation of deferred costs, obligations, or demand that is pushed into future budget periods due to current underfunding, project delays, or sudden high-volume demand. It represents a steep wave of expenses that are likely to overwhelm future budgets, commonly seen in government procurement, and in Oakland’s case, budget-balancing.

When Oakland voters approved Measure NN in November 2024 to raise $45 million in new tax revenue annually, the measure included a key requirement that Oakland maintain at least 700 sworn police officers to receive the tax revenue. That requirement was soon waived when the city council declared a state of “extreme fiscal necessity.” Like other recent parcel-tax measures, Measure NN contains an exception clause that allows the city to continue collecting the tax revenue even when it does not meet the measure’s requirements — in this case, by failing to meet the staffing threshold. As a result, parcel taxes like Measure NN have become a funding mechanism that gives the city the ability to bypass at will the public safety staffing levels voters were promised.

Oakland Report contributors. “New taxes: Oakland public employee unions collecting signatures for a new parcel tax.” Oakland Report, Feb. 3, 2026. https://www.oaklandreport.org/p/2026203-new-taxes-oakland-public-employee

California Form 460. “Recipient Committee Campaign Statement.” Oaklanders For A Safe, Clean & Healthy City, Sponsored By Labor Organizations. Feb. 2, 2026. https://public.netfile.com/Pub2/RequestPDF.aspx?id=Sy9QR0VYY29ha2tqUnIwTVFMY3JMQT09&aid=COAK

City of Oakland. “Receive An informational Report Addressing The Oakland Roadmap To Fiscal Health’s Objective Of Presenting A Phased, Multiyear Plan To Move The City Toward Compliance With Voter Mandated Staffing, Service Levels And Other Agreements.” Finance and management committee meeting, Feb. 10, 2026, agenda item #6. https://oakland.legistar.com/LegislationDetail.aspx?ID=7803529&GUID=45C4B727-1AE6-490F-8CC6-25E3BD2FF85A&Options=&Search=

Johnson, Jestin D. “Multi-year Plan to Meet Voter-Mandated Staffing and Service Levels.” Jan. 12, 2026. https://oakland.legistar.com/View.ashx?M=F&ID=15158124&GUID=8FE10C8F-603D-4D5B-99EA-69C33E88B6BC

After paying taxes upon taxes for public safety and getting much less in return (Measure Y is a prime example), I no longer trust city officials.

We had a chance to right the ship when Loren Taylor ran for mayor but most of Oakland wanted to same old failed script.

This city makes me so angry that it is unhealthy.

Might be forced to move away from Oakland if our property taxes go up any higher