Oakland’s quarterly financial report is delayed until March, amplifying budget risks

The city is skipping its Q1 Revenue and Expenditures Report this year. And the Q2 report will not be available until early March, leaving only four months to adjust spending if there is a deficit.

There has been scant news or attention lately about the City of Oakland’s financial state.

It’s unclear if this is good news, bad news, or just no news, because the city has delayed the reports that provide mid-year insight on its financial condition.

Historically, the city has issued two reports in October and November: the annual Revenue and Expenditures (R&E) report for the previous fiscal year, and the first quarter (Q1) R&E report for the current fiscal year.1

Finance Director Bradley Johnson told Oakland Report on December 23 that the annual R&E report was delayed in order to incorporate audited numbers from the city’s Annual Comprehensive Financial Report (ACFR). Johnson said the ACFR will be released next week, and the annual R&E report will be published mid-January. Use of audited financial data in R&E reports is a novel practice for the city.

Perhaps more important than the annual report are the quarterly R&E reports that forecast current-year outcomes (FY2025-26). Johnson said that the city will not publish a Q1 R&E report this year because the first quarter data is too limited. According to Johnson, that makes financial projections unreliable for decision-making. Instead, the city will only issue the Q2 R&E report at its usual time in late February or early March.

However, the early March timing of the Q2 R&E report leaves only four months for potential spending adjustments before the fiscal year ends—very little time to impact total annual expenses if there are deficits. And the city cannot tap reserve funds to cover deficits because they were spent-out last year.

Johnson told Oakland Report that the city has prioritized accuracy over timeliness in its financial reporting this year. He noted that nearly all of the critical revenue data arrive in December and January—including the first property tax and business tax receipts, and six months of Real Estate Transfer Tax revenues—which are needed for accurate forecasts. He said that due to the timing of this data, it is not possible to accelerate the Q2 R&E report.

Johnson said that he is aware of the challenges that late-in-the-year information creates for city administration and council decision-making. He noted that the finance department monitors fiscal data routinely, and if there were significant early warning signals, they would bring that information to the council sooner than March.

Why do these reports matter?

R&E reports are critical for the Oakland City Council to exercise its duty of fiscal oversight. In principle, the council may want to make mid-year spending adjustments to avoid a last-minute financial crisis—as has been the pattern in recent years—and to gather more data to determine whether imposing $40 million in proposed additional tax increases on Oakland residents2 is justified.3

But the council can’t do that if it doesn’t have up-to-date fiscal data. And the risk of deficits this year remains high, adding weight to the importance of regular financial reporting.

In September, Deputy City Administrator Monica Davis reported to the council’s Finance and Management Committee that the prior fiscal year (July 1, 2024 to June 30, 2025) may have ended with a General Purpose Fund (GPF) deficit of $55 million.4 And the deficit situation for the current fiscal year (July 1, 2025 to June 30, 2026) remains unknown.

Video clip 1. Oakland Finance Director Bradley Johnson responds to a question from then-council member Dan Kalb about reducing spending in the police and fire department budgets. Johnson had earlier noted: “If we do not change course, we will be roughly $115 million negative. We have already breached into our emergency reserve.” Oakland City Council meeting, Nov. 19, 2024.

When the council adopted the city’s two-year fiscal year 2025-27 budget in June,5 it relied on a freshly-approved half-percent sales tax increase,6 as well as $40 million in hoped-for new revenue from another future tax increase to balance the budget.7

The council did not consider staff reductions, where the bulk of the city’s budget is spent, as a means to balance the city’s budget. Without such reductions, the hoped-for new tax increase will be essential to balancing the second year of the two-year cycle. But voters haven’t approved the proposed new tax yet, and won’t vote on whether to approve it until 2026.

The council’s two-year 2025-27 budget also assumed other revenue enhancements, including an audit of delinquent business taxes, pursuing efficiencies in the collections process, and enhancing parking enforcement.

Each of these assumptions adds to the risk of a deficit by year-end. If the new tax increase is not approved by voters in 2026, or if revenue and expenditure predictions don’t materialize as hoped, the city will need to take rapid action to modify spending. The sooner such actions are taken, the less painful they will be.

See this related article:

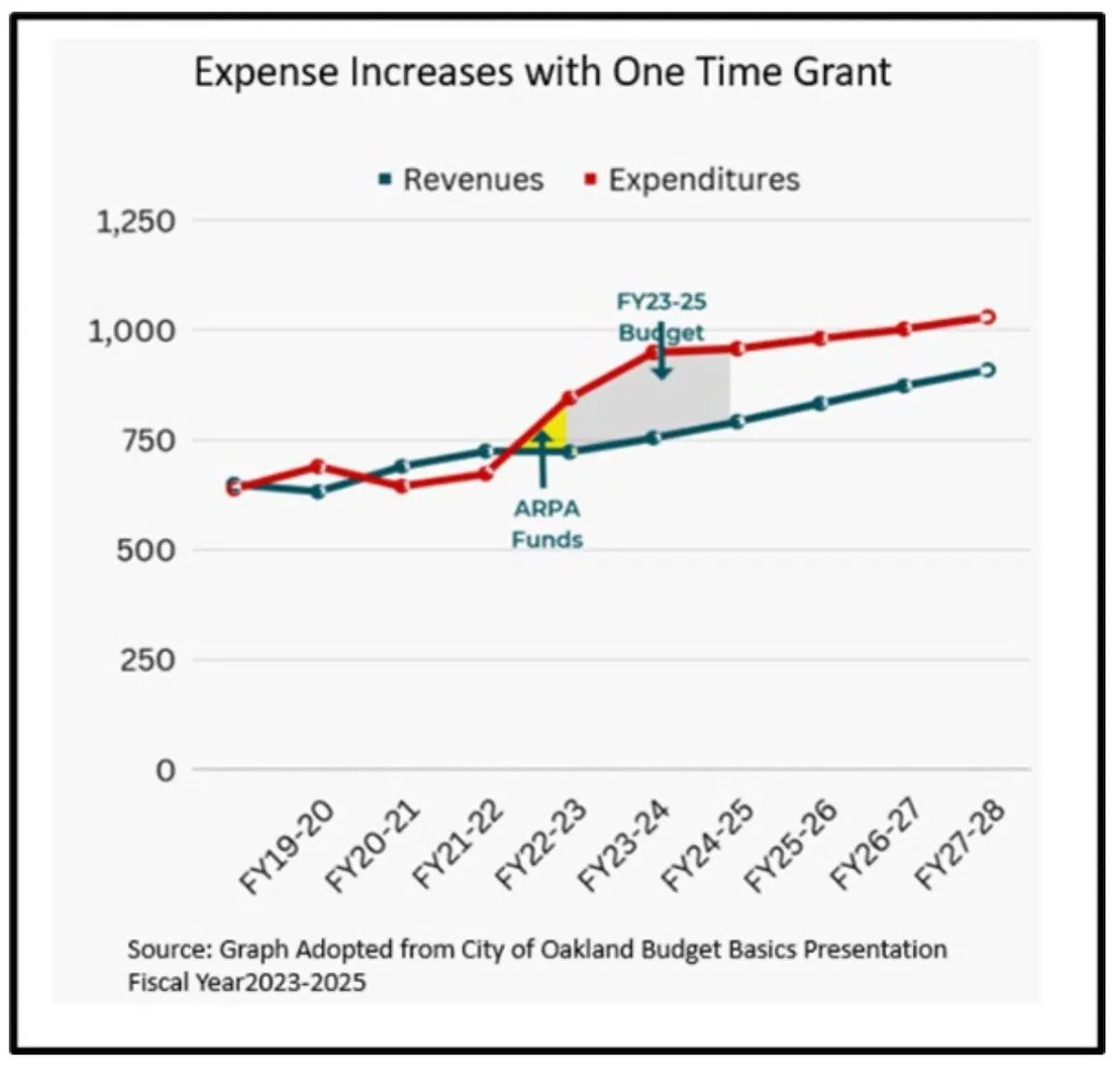

In recent years, such deficits were covered by spending one-time funds, including emergency reserves, American Rescue Plan Act (COVID-era) stimulus funds, and restricted fund balances. Use of one-time funding sources to cover operating deficits is normally prohibited. But the city council granted themselves authority to make such moves by declaring “extreme fiscal necessity.” This declaration allows the city to suspend the requirements of its Consolidated Fiscal Policy and to override voter-mandated fiscal restrictions like the minimum 700-officer staffing level required to collect spend Measure NN funds.8

This state of “extreme fiscal necessity” has been in effect for a year and a half—and, it seems, will remain in effect for the near future. But without the cushion of reserve funds, the budget-balancing leverage of this declaration is weakening, and so too may be voters’ patience with council declarations that override their will.

The annual R&E report for the previously completed fiscal year 2024-25 will show how big the deficit ended up, how the city paid for it, and the impact of redirecting restricted funds away from voter-mandated purposes.

The Pension Override Tax surplus – an unexplored opportunity to reduce the city’s operating expenses

Oakland Report has previously reported that the city has a significant surplus of funds in the Pension Override Tax Revenue account (Fund 1200).9 It is used as a kind of escrow account to pay off debt to the 1976 Police and Fire Retirement System (PFRS). PFRS is the city-operated pension fund that was closed in 1976 and replaced with CalPERS.

As of February 2025, the Pension Override Tax Revenue account held a balance of $381 million (a distinct pot of money from the approximately $500 million in the actual PFRS fund).10 The city’s actuaries estimate a potential surplus of $262 million in the account at the end of 2026, after the PFRS debt is fully paid off.11

Such funds cannot be used for city operations because they are dedicated to pensions. But they could potentially be used to pay down CalPERS Unfunded Actuarial Liabilities (UALs), saving the city around $20 million annually in interest payments, while further securing employee retirements.

See this related article:

Given that the city is considering imposing $40 million or more in additional tax burden on residents, Oakland Report asked finance director Johnson if the city administration was considering this option of paying down CalPERS UALs as an alternative to levying more taxes.

Johnson told Oakland Report that the administration is aware of that option, among many options to address Oakland’s ongoing financial problems, but he did not indicate whether it was being actively pursued. He noted only that any such decisions would require involvement of many stakeholders including the PFRS board, and would take a substantial amount of effort and time.

Additional insight to the status of this surplus should be available early March when the city releases the Q2 FY2025-26 R&E report, with updated Pension Override Tax Revenue fund balances, and also should release the 2025 PFRS Actuarial Report, with updated surplus estimates.

Background on the city’s financial reporting obligations

The annual revenue and expenditures report is required by the council-approved Consolidated Fiscal Policy:

“Each fiscal year the City Administrator shall report to the City Council on actual revenues and expenditures in the General Purpose Fund and other funds as deemed necessary.”

— from the City of Oakland Consolidated Fiscal Policy12

Beyond ordinance policy requirements, the city administrator has a duty under the city charter to provide timely fiscal information to the city council and the public. Per section 504 of the city charter, the city administrator has an explicit duty “to keep the Council at all times fully advised as to the financial condition and needs of the City.”13

Quarterly R&E reports are the mechanism by which that duty has been carried out in the past; and they are also an ethical obligation to the public. As the city administration itself stated in the fiscal year 2023–24 Q3 R&E report:

“This report supports the Citywide priority of a responsive, trustworthy government because providing timely and up-to-date financial information enhances transparency, allowing residents, stakeholders, and decision-makers to be informed of the City’s fiscal health, promoting a culture of responsible financial stewardship.”

— from the City of Oakland FY 2023–24 Q3 Revenue and Expenditures report14

The council’s access to city operational and financial information is no different than that of the general public. The council relies on the city’s financial reports to carry out its obligations—including adopting the budget, ensuring expenditures align with adopted priorities, preventing deficit spending as required by state law,15 and maintaining required reserve levels as required by the Consolidated Fiscal Policy.

These responsibilities require timely production of current and projected revenue, expenditures, fund balance, and reserve information during the fiscal year, so that necessary operating changes can be made before it’s too late.

Former city attorney John Russo articulated the responsibilities of both the council and the city administration in a 2003 memo to the council explaining their roles under the current charter:

“When and if the City Council is silent or if its policy direction is unclear, the City Manager has broad authority to manage the City’s affairs in a manner consistent with his sound judgment so long as he keeps the Council advised of the financial status and plans. The Council then has both legislative and budgetary power which must be respected.”

— John Russo, Oakland City Attorney memorandum to Oakland City Council, 2003.16

In short, the charter requires routine and transparent disclosure of fiscal conditions by the city to the elected council that governs it.

City of Oakland - Finance Department. “Revenue & Expenditure Reports.” Accessed Dec. 23, 2025. https://www.oaklandca.gov/Government/Finance-Budget/Financial-Reporting/Revenue-Expenditure-Reports

City of Oakland. “Finance and Management Committee meeting agenda.” Options To Raise Additional Ongoing $40 Million In General Purpose Fund Revenues From: Office Of The City Administrator Recommendation: Receive An Informational Report With A List Of Options To Raise An Additional Ongoing $40 Million In General Purpose Fund Revenues Via An Ordinance To Adopt Or Increase A Tax Effective July 1, 2026, To Provide Ongoing Resources For Public Safety Services And To Maintain Key Equipment, IT Systems, And 911 Investments. Oakland, California, Oct. 28, 2025, agenda item #3. https://oakland.legistar.com/LegislationDetail.aspx?ID=7682816&GUID=99E7DA17-0010-4166-956C-916DD82AF7CC&Options=ID%7CText%7C&Search=List+of+Options

Reinhart, Sean S. “‘Death and Taxes’ - Oakland City Council is the One Who Knocks.” Oakland Report, Oct. 27, 2025. https://www.oaklandreport.org/p/death-and-taxes-oakland-city-council

City of Oakland. “Fiscal Year 2025-2027 Budget.” Accessed June 11, 2025. https://www.oaklandca.gov/Government/Finance-Budget/Budget/Fiscal-Year-2025-2027-Budget

City of Oakland, Ballot Measure Submittal Form to Alameda County Register of Voters (Measure A, 0.5% increase in the sales tax). https://acvote.alamedacountyca.gov/acvote-assets/02_election_information/PDFs/20250415/en/oaklandmeasure20250415.pdf

City of Oakland Measure NN. Oakland, California, Nov. 5, 2024. https://acvote.alamedacountyca.gov/acvote-assets/02_election_information/PDFs/20241105/en/Measures/32%20-%20Measure%20NN%20-%20City%20of%20Oakland%20-%20Citywide%20Violence%20Reduction%20Services.pdf

Gardner, Tim. “We can balance Oakland’s budget without selling the future.” Oakland Report, Oct. 13, 2024. https://www.oaklandreport.org/p/we-can-balance-oaklands-budget-without

City of Oakland. “Concurrent Meeting of the Oakland Redevelopment Successor Agency and the City Council.” Receive An Informational Report On Fiscal Year (FY) 2024-25 Second Quarter (Q2) Results And Year-End Estimates For The General Purpose Fund (GPF, 1010), And Select Funds, And An Update On Current Year Balancing Efforts. Oakland, California, Mar. 18, 2025, agenda item #10, Appendix A. https://oakland.legistar.com/LegislationDetail.aspx?ID=7135437&GUID=20E4D470-E0AE-445A-846D-400D25651C99&Options=ID|Text|&Search=Revenue+and+Expenditures

City of Oakland. “Rules and Legislation Committee meeting agenda.” Oakland PFRS’s Actuary Report As Of July 1, 2024. Oakland, California, Mar. 27, 2025, agenda item #3.17. https://oakland.legistar.com/LegislationDetail.aspx?ID=7150204&GUID=97F89BEF-A517-4672-A613-6D9844A03676&Options=ID|Text|&Search=Informational+Report+On+The+Oakland+Police+And+Fire+Retirement+System

City of Oakland. “Ordinance No. 13487 C.M.S. (Consolidated Fiscal Policy).” Adopted April 13, 2018. https://oakland.legistar.com/View.ashx?M=F&ID=6260762&GUID=DCAC0064-A107-48C3-A4E3-CB0AD3972758

The Charter of the City of Oakland. “Article V - The City Manager, Section 504. Duties.” https://library.municode.com/ca/oakland/codes/code_of_ordinances/283553?nodeId=THCHOA_ARTVTHMA

City of Oakland. “FY 2023–24 third quarter revenue and expenditures report, PDF (cao-94612 S3).” https://cao-94612.s3.us-west-2.amazonaws.com/documents/FY-2023-24-Q3-RE-Report.pdf

California Constitution. “Article XVI, Article XVI - Public Finance, Section 18.” https://law.justia.com/constitution/california/article-xvi/section-18/

Russo, John. “City attorney legal opinion - City Manager’s Powers.” Oakland, California, Feb. 6, 2003. https://www.oaklandcityattorney.org/wp-content/oca-reports/public-legal-opinions-and-public-reports/2003-02-06-CityMngrPowers_2003.pdf

Tim, thank you for this important update. Imagine if you did not check your household bank account or credit card balances for nearly six months. That is something akin to what the city council is doing by not reviewing the city’s quarterly financial reports.

I can’t believe that Council Members are flying the “City of Oakland” airplane blindfolded because the most recent comprehensive city financial report is almost 9 months old!