City set to forgive $8 million loan to affordable housing landlord

East Bay Asian Local Development Corporation (EBALDC) says that two properties will be foreclosed – and affordable deed restrictions removed – unless the city comes to the rescue

The city council is set to forgive $8 million in outstanding principal and interest owed by East Bay Asian Local Development Corporation (EBALDC) for two apartment complexes it acquired and refurbished with loans from the city.1

EBALDC states that if the loans are not forgiven, the properties will go into foreclosure, which would eliminate the deed restrictions that currently require the rents to remain affordable through the year 2073.

The two apartment complexes are the Highland Palms property at 1810 E. 25th Street and the Eastlake Apartments property at 2515 10th Avenue. They contain a combined 58 units of deed-restricted affordable housing.

If approved by the city council, the $8 million loan forgiveness would equate to a giveaway of approximately $138,000 per unit.

Properties are underwater and losing money

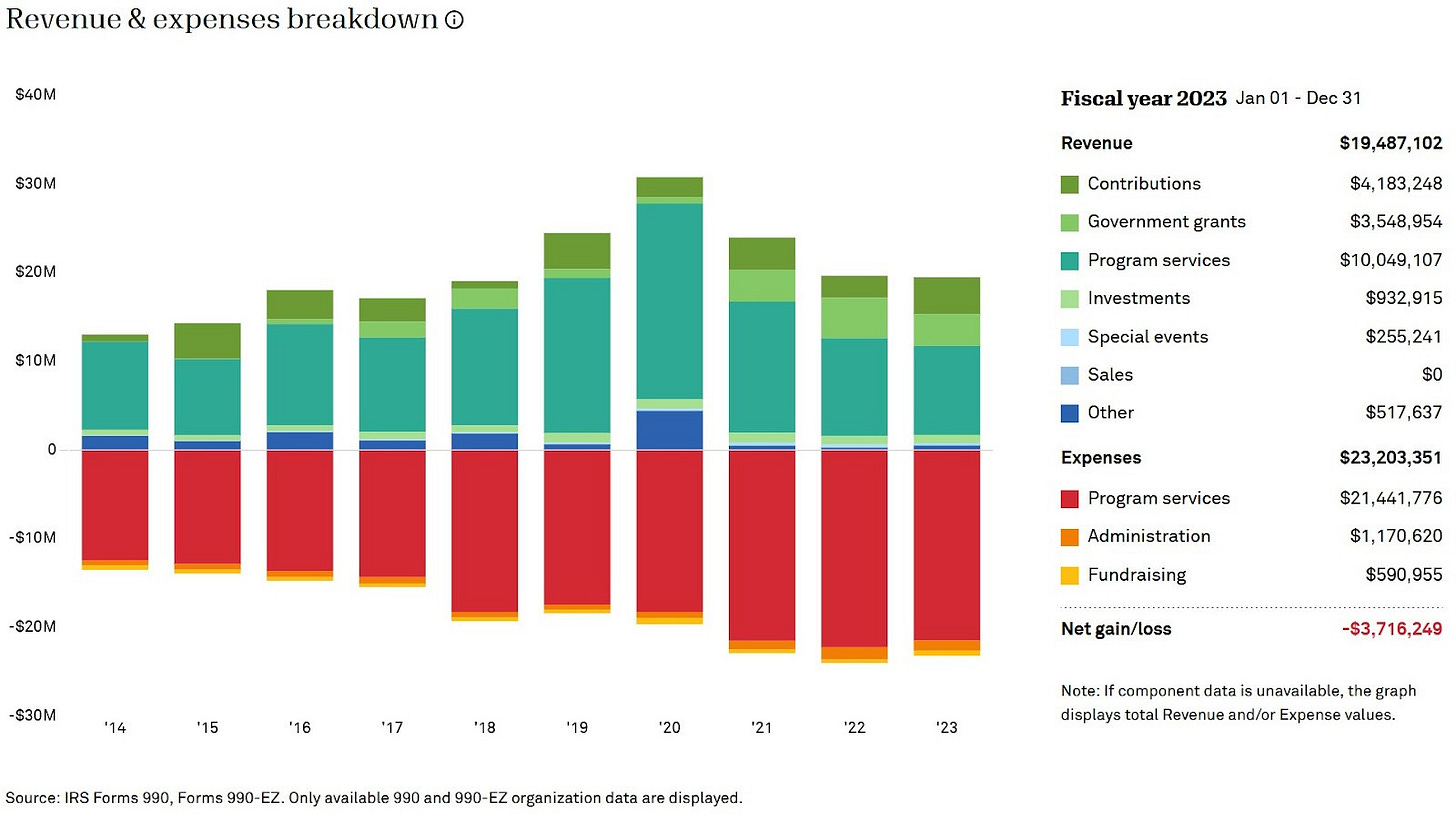

EBALDC is Oakland’s largest nonprofit affordable housing landlord with approximately 2,100 existing housing units in 27 properties.2 Its real estate assets include commercial and residential properties. Its total revenues in 2023 were $19.5 million.3

According to the December 2 staff report, recent property assessments valued Highland Palms between $2.75 million to $3.25 million (up to $141,000 per unit) and Eastlake between $2.85 million to $3.35 million (up to $96,000 per unit).

According to the staff report, EBALDC is seeking to improve its financial position by selling the Highland Palms and Eastlake properties to a new buyer which has agreed to preserve the properties as deed-restricted affordable housing until 2073.4

The proposed sale is anticipated to fall within a price range of $80,000 to $139,000 per unit. The sale is contingent on city council forgiving the $8 million loan.

Underestimated repair costs

According to the staff report, EBALDC has experienced “financial distress and operational challenges—such as depleted reserves, high vacancy rates, and deferred maintenance that have plagued Eastlake and Highland Palms due to underestimated repair costs and market shifts.”

The Eastlake property, built in 1957, suffers from significant physical problems, including chronic moisture intrusion and microbial growth that have required over $1.1 million in capital repairs, including a seismic retrofit.

Highland Palms, built in 1964, underwent a seismic retrofit, suffered a major fire in 2021 and required a partial renovation in 2023. In total, over $3.3 million was invested in capital repairs to the property.

The report indicates that the physical problems at the two properties were not fully identified during the pre-acquisition phase, which led to unplanned costs, inadequate funding and recurring financial problems.

Eviction moratorium caused $3.4 million loss

Two EBALDC senior representatives who spoke to Oakland Report on condition of anonymity said that the City of Oakland’s COVID-19 eviction moratorium is partly to blame for the properties failing to meet expenses.

Oakland’s eviction moratorium lasted from March 9, 2020, through July 14, 2023. During that over three-year period, landlords could not evict tenants for non-payment of rent if the hardship was caused by the pandemic.5

The EBALDC representatives estimated to Oakland Report that the eviction moratorium cost them $3.4 million in lost rental income.

An offer they can’t refuse

One EBALDC senior representative, speaking on condition of anonymity summed up the issue to Oakland Report this way:

“[The Highland Palms and Eastlake] properties are under water in value and cash flow negative. Whether the city forgives [the loan] or not the investment is lost. If the lender in first position forecloses, the city loan is lost. The city has a choice: forgive its loans to allow the sale so the units can stay deed restricted affordable or allow the properties to go into foreclosure, have the loans wiped out in bankruptcy and the units go back into the speculative market.”

– EBALDC senior representative, speaking to Oakland Report on condition of anonymity

Oakland Report has reached out to city staff to ask if the above is an accurate summary of the city’s available options. The staff report, while recommending the loan forgiveness, notes that “no other property in the City’s affordable housing portfolio has had its loan forgiven and been sold to a new buyer.”

As a result of the loan forgiveness, EBALDC would be banned from applying for city housing funds for 24 months, and the new buyer would be subject to various accountability measures intended to prevent a recurrence of the financial issues that led EBALDC essentially to default on its loans.

Oakland City Council meeting, December 2, 2025, agenda item #5.16

As with most affordable housing-related deals, the proposed loan forgiveness involves multiple nuanced and complex financial, political, legal and regulatory considerations.

For a comprehensive review of the various technical details and justifications for the proposal, the staff report and supporting materials for the December 2 city council meeting are available on the city’s agenda webpage.

A presentation prepared by city staff summarizing the loan forgiveness proposal can be viewed here.

If you like our work, please consider donating. We are a volunteer-run, 501(c)(3) charitable nonprofit organization based in beautiful Oakland, California.

Our mission is to make truth more accessible to all Oakland residents through deep investigative reporting and evidence-based analysis of local issues.

Your donation of any amount helps us continue our work to produce articles like the ones our readers wrote about in this column.

Thank you.

City of Oakland. “Concurrent Meeting of the Oakland Redevelopment Successor Agency and the City Council.” Adopt A Resolution Authorizing The City Administrator To Forgive $3,000,000 In Outstanding Principal And All Accrued And Unpaid Interest Owed By East Bay Highland Palms II, LP For The Highland Palms Property, And $5,000,000 In Outstanding Principal And All Accrued And Unpaid Interest Owed By East Bay Capital Fund II, LP For The Eastlake Property, To Preserve Long-Term Affordability Until 2073 And Facilitate The Property Sale To A New Owner. Agenda item #5.16, Dec. 2, 2025. https://oakland.legistar.com/LegislationDetail.aspx?ID=7717961&GUID=EBDD27F8-76F0-4689-B8E6-189BCD24E1F0

All properties - EBALDC. East Bay Asian Local Development Corporation. Dec. 1, 2025. https://ebaldc.org/properties/

Organizational profile - East Bay Asian Local Development Corporation. Guidestar / Candid. Dec. 1, 2025. https://app.candid.org/profile/7747056/east-bay-asian-local-development-corp-51-0171851?activeTab=5. (Site login required; see below to download.)

CCH. Christian Church Homes. Dec. 1, 2025. https://wearecch.org/

Pelit, Attila and Kelly O’Mara. “Oakland Eviction Moratorium Ends: What You Need to Know.” KQED, July 15, 2023. https://www.kqed.org/news/11955733/oaklands-eviction-moratorium-just-ended-whats-next-for-renters-and-landlords

There is an underlying absence of economic reality behind the housing policies and decisions of Oakland 's political leadership over the past several decades. "Activists' have been driving the bus in almost total darkness, ignoring the basic economics of housing. This story should surprise nobody. Housing is expensive to operate and maintain, especially older buildings with tenants with challenges. Limiting rents removes a property from market signals and realities, creating a fantasy set of budget and operating numbers. Eventually, reality comes knocking and the same politicians either retire, hide, rationalize, or distract with blame of others. We are likely to see this same story play out over and over again as more and more Oakland housing 'disappears' and no new housing replaces it. Economic reality is difficult, often painful, but ultimately unavoidable, despite attractive ideology to the contrary.